5 Easy Pitfalls to Avoid in your Twenties

When we are in our twenties, we feel like we are invincible. Unfortunately, we are not, and there are some easy pitfalls that you can make in your twenties. Here are 5 pitfalls to avoid in your twenties. The purpose of this article is to help boost your financial IQ.

Table of Contents

Pitfall #1: Forgoing insurance

Regardless of what you think or what your buddies tell you, you are not indestructible. It is in your best interest to understand this lesson now instead of when you have to part with money for an ambulance ride to the hospital and be in debt.

Or when you are sued for an auto accident that you caused or if your residence gets burglarized and you have to replace all the items. This is why you should shop around for insurance. Look for reliable and affordable insurance and incorporate it into your budget.

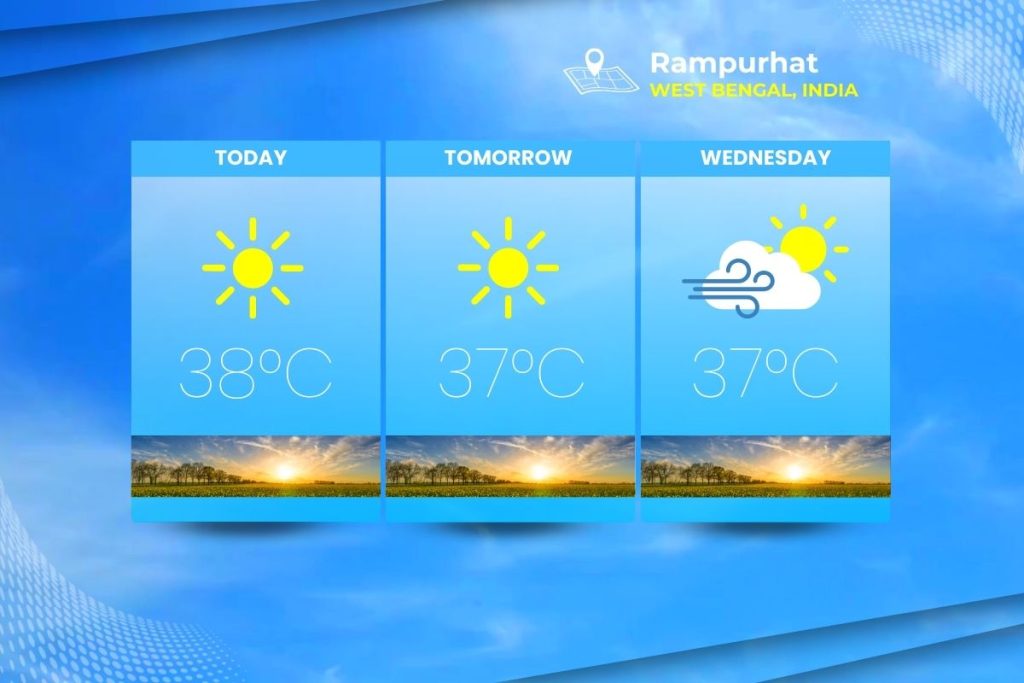

Insurance can help with accidents that are beyond your control such as a snowstorm that can break your home. This is why insurance and even a Snow Day Predictor can help mitigate these risks.

Pitfall #2: Ignoring your credit rating

Number seven on the list of pitfalls to avoid is neglecting your credit score and letting it slump. Do you know that your history determines your credit score? This means that any poor financial decisions and bad records in your twenties, such as missed payments, will have far-reaching ramifications.

All is not lost as you can mend the damage done in your twenties, though it takes time. So the best advice is, to begin with, good credit from the word go.

Pitfall #3: Taking loans to fund your wedding

In as much as your wedding should be spectacular, it is, after all, just a single day. Why take loans and enter into marriage with lots of loans hanging over your head? You can just prepare a sensible budget and consider all options while avoiding debt.

Pitfall #4: Not talking about money issues with your partner

This pitfall is linked with the above (Number eight) pitfall. Financial conversations aren’t the best of discussions, but there are vital nonetheless. Discuss ways to save money and invest, plus how to go about making massive purchases. Be open about your perspective on money and work together to devise sensible financial objectives.

In Florida, there are some When you don’t discuss your money issues with your partner, you may be more susceptible to financial hardship and have to pursue a Chapter 7 Means Test Calculator or a Chapter 13 Bankruptcy Florida.

Pitfall #5: Having your financial security dependent on friends’ or family’s money

On the road to financial security, make sure that you are not dependent on family and friends for money. Many friendships have been terminated because of involving money, especially when you take a loan from friends and fail to pay it. To maintain healthy friendships and family ties, approach your bank for a loan if necessary.

You should consider a budget to track your income and expenses such as a Google Sheets Budget Template.

February 11, 2020