Learn Commodity Trading Secrets

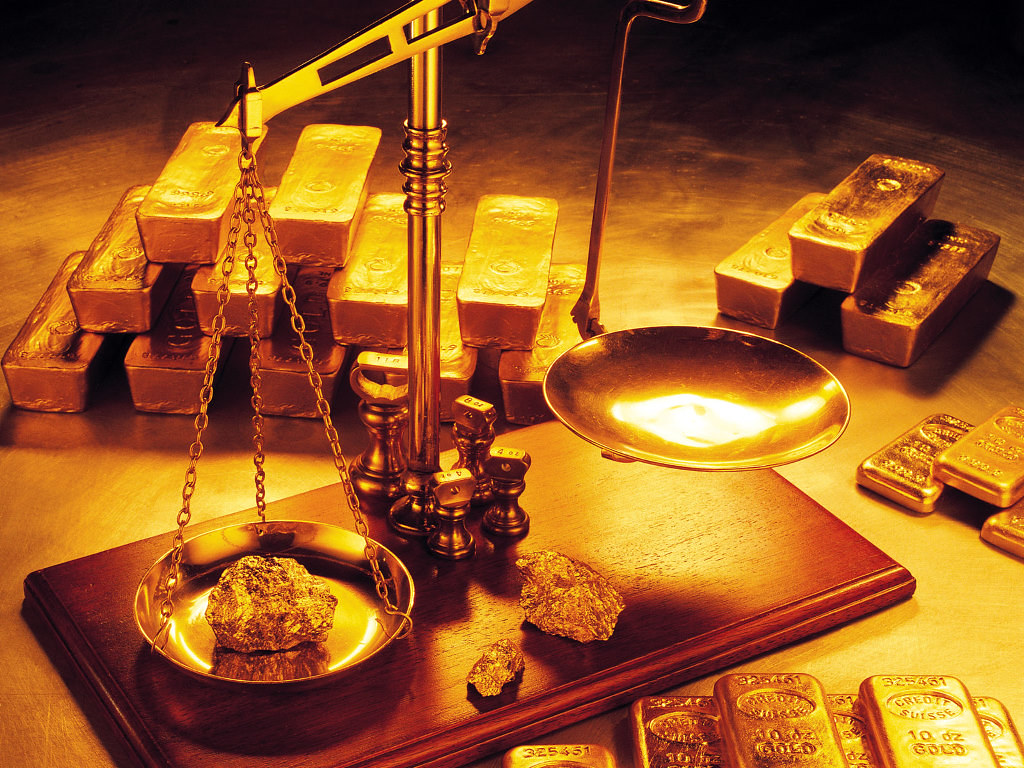

According to experienced Commodity Trader – Rowan Relton, commodity trading entails the buying, selling or trading in raw products which can be anything from cocoa, oil, gold, sugar and any other primary economic products you can think of. Commodities are the foundation of any economy and they are the basis on which every other thing are birthed. Hence, trading in commodities can be a smart decision anyone can ever make as it promises huge returns on investment.

However, to be successful in any trading, there are keys to hitting it right and commodities are not exceptions. These keys are strategies that make the difference on whether you go with a lot of gains or you lose it all at a go. That is why we spoke to one of the best in the trading world, Rowan Relton, a dedicated trading professional to shares the secrets of commodity trading. Keep reading!

‘Commodity trading is far different from any other financial instrument. It’s a different ball game and any prospective investor irrespective of other trading experience needs to master commodity trading on its own,’ says Rowan Relton.

Table of Contents

Discover your Niche

Commodity worldwide and diverse and you might have to choose and stick to a market or two that works very well for you. The point is that very few successful traders have understood and can trade all the aspects of the commodity market well. Therefore, if you are just starting, you might need to find your niche, know the ins and outs, and get started, says Rowan Relton. If you know about precious metal, you can consider this aspect and if yours is oil, then you might want to become an oil trader. However, discovering your market might require some trial and error. You might have to try different market segments to know which one you are doing well in and which one is giving you a tough time. Within a short period of time, you will discover your niche.

Understand the Trend

Just like any other trad-able assets, there are also fluctuations in proxies in commodity trading. This means more money for investors especially when the trend is in your favor. Commodity prices are greatly influenced by the law of demand and supply. When there is high demand, and short supply, prices tend to shoot higher and when there is an oversupply with low demand, prices fall. When the happens, it tends to be long-lasting. A good example is the price of gold that reaches an all-time high during the COVID-19 pandemics as investors run for safety.

Grab Opportunities in the Market Nature

Commodities are unique and they tend to be influenced by seasons as well. Smart investors know that understanding these seasons can make a difference in winning or losing. Agricultural commodities for instance sometimes follow seasonal price patterns. Some commodities rise in the winter months when there is high demand and fall off during summer time when demand is low, says commodity trader – Rowan Relton.

Conclusion

Commodity trading is open for everyone. And just like any other trading, investors need to leverage the technical tools and be armed with information that can help to minimize risk, control loss while maximizing gains.

July 9, 2021