Currency Trend Following – Cope With Standard Deviation and Enjoy Huge Gains

If you’re interested in foreign money fashion following you then definitely want to apprehend and address fashionable deviation of fee – in case you do not you’ll lose and it is a widespread and underestimated vicinity to examine for forex success…

Table of Contents

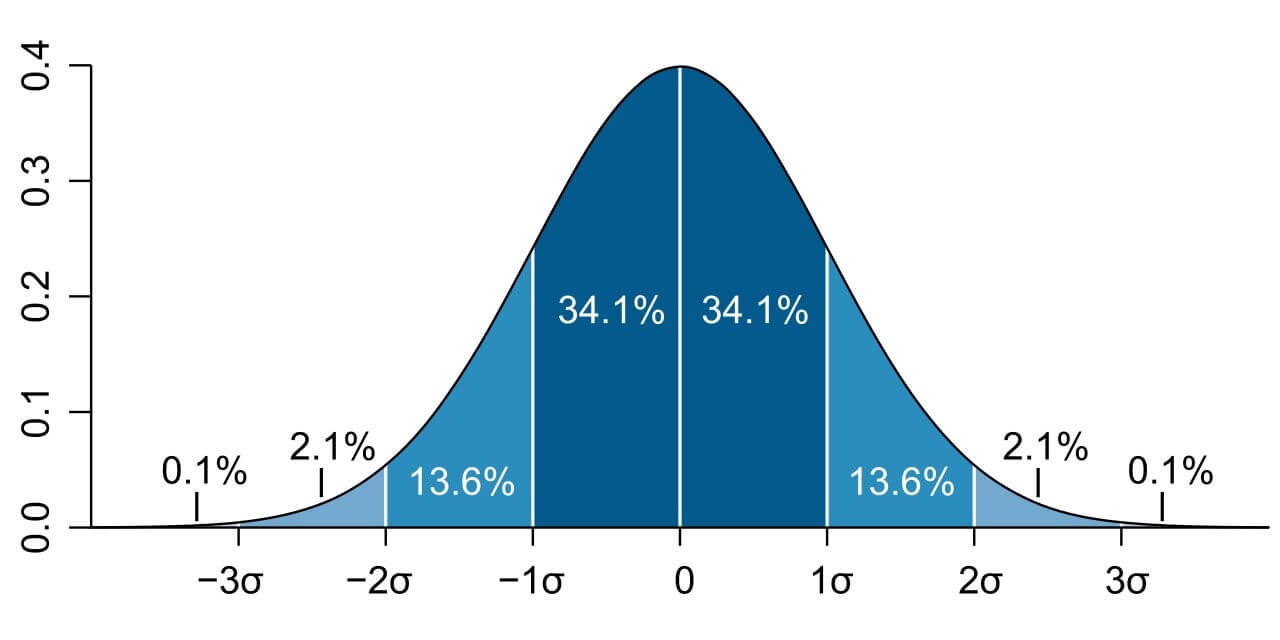

Standard Deviation

Let’s have a take observe foreign money fashion following and the way fashionable deviation allows you to spot developments and maintain them and get larger earnings out of your foreign exchange buying and selling. Standard Deviation truly measures volatility statistically and suggests the distinction of the values from the common one and is calculated via way of means of taking the rectangular root of the variance, the common of the squared deviations from the suggested.

In easy terms:

The volatility in addition to the same old deviation of the marketplace studied receives better if the ultimate fees and common ultimate fees range considerably. If the distinction is small the same old deviation and the volatility of the marketplace is low.

Fact:

Humans make the fee of any marketplace and they’ll push fees underneath or above the common, while the feelings of greed and worry come into play. This in no way modifications due to the fact human psychology in no way modifications – human beings continually push fees to a long way up or down and continually will. These fee spikes have a tendency to be transient and fees subsequently fall returned to the truthful price or the common.

You can spot fee spikes on any foreign exchange chart and the large spikes truly do not final lengthy they go back to truthful price – Understand this and you’ll have a head begin in your quest for earnings together along with your foreign exchange buying and selling strategy.

Keep those factors in mind:

1. The reversals of developments are observed via way of means of excessive volatility stages as fees blow off.

2. A chart breakout after low volatility that sees excessive volatility spread can imply anew large fashion is underway.

3. High volatility inside any fashion in motion, is not an unusual place, and investors can take earnings on those spikes and upload them to new positions on dips to the common.

An excellent device to apply on the subject of volatility is the Bollinger Band which has outer bands (the same old deviation) and the center band which represents the common or suggest fee. The Bollinger band is a splendid device for recognizing new developments, recognizing reversals, and stepping into current developments, while the hazard/praise is at its best.

When following foreign money developments many investors can choose the foreign money course correctly – however, lose due to the fact they have got their stops withinside the incorrect area or maintain developments for too lengthy. The Bollinger band can assist with all of those issues and assist you to decorate your earnings potential.

One of the keys to a successful fashion following is balancing the hazard praise and in case you use Bollinger bands alongside momentum signs and assist and resistance, you’ll time your buying and selling indicators with more accuracy, live with developments longer, and spot turning factors better.

When foreign money fashion following, in case you need to win and seize and maintain the large developments you want to apprehend volatility and fashionable deviation of fee – in case you do not, you’ll in all likelihood lose, so make it a vital a part of your foreign exchange buying and selling education.

February 10, 2021