25 Ways to Save Money on Home Insurance

Home Insurance Factors

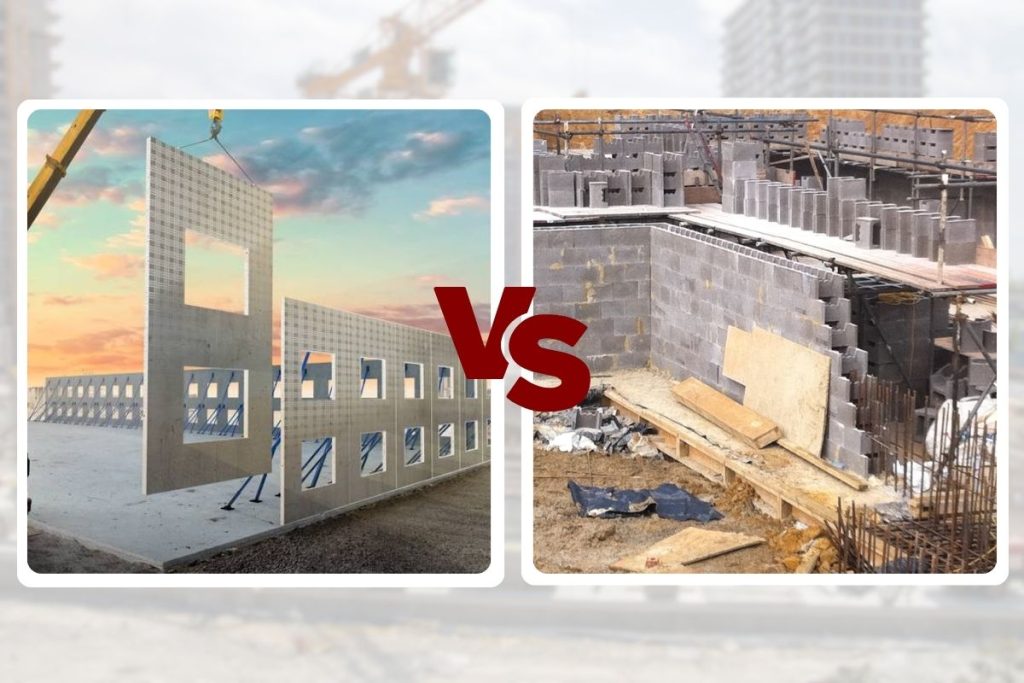

There are numerous Home Insurance factors compared with a home that decide the rate that is charged for safeguarding the property. For instance, homes developed of Brick and that are segregated from different homes will get less expensive protection rates than a home built of wood and that is connected on one or two sides. Likewise, a 3 family home will cost more to guarantee than a one-family home, as every unit adds one more expected danger with additional ovens, kitchens, potential water spills, and expanded opportunities for human mistakes that might cause a fire.

The following are far to save money on your home protection:

1) Purchasing a fresher home will bring about lower protection rates.

2) Homes with level rooftops might cause more than homes with pitched rooftops as the latter will in general safeguard more against holes and implodes (for example from collected snow or ice on the rooftop).

3) Install a focal caution framework (a framework that naturally cautions the local group of fire-fighters or police assuming there is a crisis) as opposed to a nearby caution. This can bring about a good rebate, maybe 10%.

4) When deciding the protection sum on the structure, leave out the land as you are safeguarding only the structure. Keep in mind, that the land doesn’t consume and rates depend on the substitution cost of the structure and not the assessed worth of the property.

5) If you own horrendous creatures, for example, pit bulls, remember that numerous home insurance agency might decline to guarantee your property or will charge higher rates, because of the expanded obligation.

6) Raise your deductible. By raising the deductible from express $500 to $2,000 you can save a decent sum on your protection. Keep in mind, that you are protecting against horrendous misfortune, not to cover any predictable misfortune.

7) Verify in the event that your manager offers a gathering rebate game plan (likewise called partiality bunch limits) with a specific home insurance agency.

8) If looking for a home, attempt to stay away from homes in an assigned flood region as this will expect you to likewise buy flood protection notwithstanding property holders’ protection.

9) If you don’t want to be a property manager, purchase a one-family home as these are more affordable to safeguard than a 2 or 3-family home.

10) Maintain a decent credit score as numerous safety net providers presently rate in view of your record as a consumer.

11) Always safeguard on substitution cost (RC) rather than genuine money esteem (ACV), as the previous gives more inclusion in case of a misfortune.

12) Don’t change up. A few people look around consistently for lower protection rates and this will just damage them over the long haul in light of the fact that numerous home insurance agencies reward the individuals who stay with them over an extended time, with potential limits or devotion credits not too far off. A few guarantors offer limits whenever you have been with them for 5 or 6 years.

13) Make sure your house is gotten by deadbolts, smoke alarms, fire dousers, and thief caution as these can assist you with getting extra credits for a lower rate.

14) Consider a bundled strategy. You ought to get a superior rate by joining your home and auto in a similar strategy.

15) If material, consistently request a senior resident markdown.

16) Review your strategy yearly. Ensure that your property is protected for the right to add up to keep away from that your property is underinsured, as over the long run the worth of the property and its substitution costs will without a doubt increment.

17) Remember, much of the time in the event that you don’t ask you will not get it! So consistently get some information about the limits that are all suitable. In the event that they don’t chip in any, get some information about unambiguous things (for example focal alert framework).

18) Upgrades. You will get a superior rate if the pipes, rooftop, warming, and electrical have been overhauled inside the last 10.

19) Avoid negligible cases. Assuming you have had earlier cases throughout recent years, this will bring about higher rates. So attempt to try not to make claims on little misfortunes; subsequently the reasoning for a higher deductible.

20) Sprinkler framework. Albeit this may not be a commonsense cost for the majority, an indoor sprinkler framework ought to accommodate a weighty rebate.

21) If you own more than one property, ask whether you will get a bundle markdown by guaranteeing more than one property with a similar organization.

22) Verify in the event that you will get limits for paying electronically by means of electronic assets moving from your financial records.

23) See in the event that you can get a rebate by covering every year rather than by portions.

24) If you don’t smoke, confirm in the event that your home insurance agency offers a nonsmoker markdown.

25) When looking for a home, attempt to find homes found more like a Fire station (under 5 miles), and that are arranged near a fire hydrant (the nearby the better).

August 2, 2022