Decentralized Finance (DeFi) – Disrupting Finance Through Blockchain Technology

Decentralized finance (DeFi) has emerged as a revolutionary concept in the financial world. It aims to create an open and accessible financial system by removing the need for centralized institutions like banks and brokerage firms.

“DeFi leverages blockchain technology to create an open and permissionless financial system, removing intermediaries and enabling peer-to-peer transactions,” Jed Anthony Ariens explains. Anyone with an internet connection, regardless of their location or socioeconomic status can have access to financial services, he adds.

Financial expert, Jed Anthony Ariens delves into the core principles of DeFi, its functionalities, and how it operates.

Table of Contents

Traditional Finance vs. Decentralized Finance

Traditionally, financial services are provided by centralized institutions that act as intermediaries. Banks manage our savings, facilitate loans, and handle transactions. Brokerage houses oversee the buying and selling of securities. These institutions offer security and stability, but they also come with limitations. They can impose fees, restrict access to certain financial products, and limit transaction times.

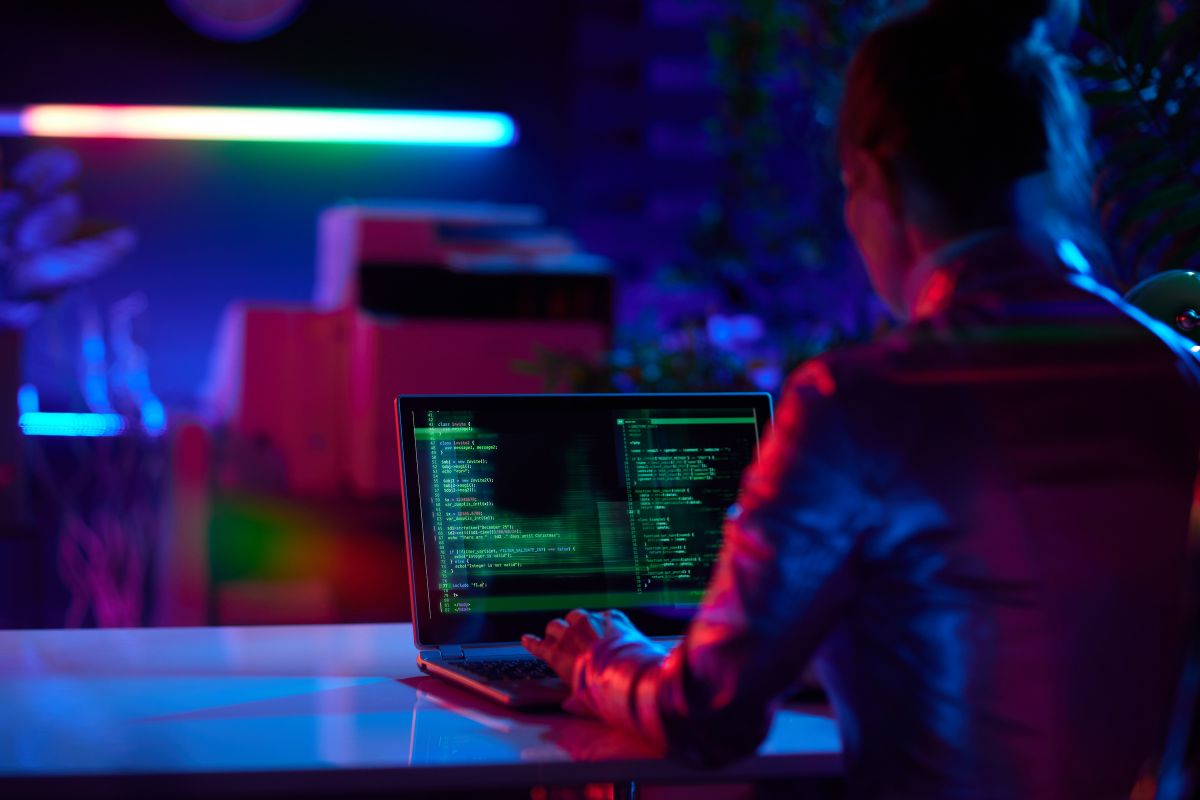

DeFi disrupts this model by leveraging blockchain technology, the same technology that underpins cryptocurrencies like Bitcoin. Blockchain is a distributed ledger system that records transactions securely and transparently across a network of computers. This eliminates the need for a central authority to verify and approve transactions.

Jed Anthony Ariens says In DeFi, financial products and services are built on top of blockchains, primarily Ethereum. These applications, known as DeFi protocols, are powered by smart contracts – self-executing code stored on the blockchain. Smart contracts define the terms of an agreement and automatically execute them when predetermined conditions are met. This removes the need for manual intervention and human error from financial transactions.

Core Principles of DeFi

- Decentralization: DeFi eliminates the reliance on centralized institutions, empowering individuals to manage their finances directly.

- Transparency: All transactions on a DeFi protocol are recorded on the blockchain, providing a public and immutable audit trail.

- Openness: DeFi protocols are typically open-source, allowing anyone to inspect the code and participate in the network.

- Accessibility: DeFi services are generally borderless and permissionless, meaning anyone with an internet connection can access them.

DeFi Functionalities: A Glimpse into the Possibilities

Jed Anthony Ariens says DeFi offers a broad spectrum of financial services, replicating many functions traditionally provided by banks and other institutions. Here’s a look at some key DeFi functionalities:

- Lending and Borrowing: DeFi platforms allow users to lend and borrow cryptocurrencies without relying on banks. Users can earn interest on their crypto holdings by lending them to others, while borrowers can access funds at competitive rates.

- Trading: DeFi facilitates peer-to-peer cryptocurrency trading through decentralized exchanges (DEXs). Unlike traditional exchanges, DEXs do not hold user funds, reducing the risk of exchange hacks.

- Yield Farming: This strategy involves moving crypto assets between different DeFi protocols to maximize returns. However, it can be complex and carries inherent risks.

- Derivatives: DeFi enables the creation of derivative instruments like options and futures contracts, allowing users to speculate on the price movements of cryptocurrencies.

- Insurance: DeFi offers innovative insurance products built on smart contracts, potentially providing users with a more efficient and transparent alternative to traditional insurance.

How Does DeFi Work? Unveiling the Mechanics

Let’s delve into the mechanics of a DeFi lending platform to illustrate how DeFi works:

- User deposits cryptocurrency: A user deposits cryptocurrency into a DeFi lending pool. This pool acts as a shared pot of funds that can be borrowed by others.

- Smart contracts automate borrowing: The lending pool is governed by smart contracts that define the interest rates and terms for borrowing. Users can borrow crypto assets from the pool by locking in collateral (usually another cryptocurrency) worth more than the borrowed amount.

- Interest accrues and is distributed: As borrowers repay their loans with interest, the interest earned is distributed proportionally to the lenders who contributed to the pool.

- Transparency through blockchain: All transactions, including deposits, withdrawals, borrows, and repayments, are recorded on the blockchain for public verification. This ensures transparency and immutability of the lending process.

Advantages and Potential of DeFi

DeFi offers several potential advantages over traditional finance:

- Accessibility: DeFi provides financial services to anyone with an internet connection, even those who are unbanked or underbanked.

- Transparency: The blockchain ensures complete transparency in transactions, fostering trust and reducing the risk of fraud.

- Efficiency: DeFi can automate many financial processes, potentially reducing costs and transaction times.

- Innovation: DeFi fosters innovation in the financial sector by enabling the development of new financial products and services.

However, DeFi is still in its nascent stages and faces certain challenges:

- Security: DeFi protocols are susceptible to hacking and smart contract exploits. Users need to be cautious and conduct thorough research before interacting with any DeFi platform.

- Regulation: The regulatory landscape surrounding DeFi is still evolving, which can create uncertainty for users and developers.

- Volatility: The cryptocurrency market is inherently volatile, which can impact the value of DeFi assets and returns.

Wrap up

“DeFi represents a groundbreaking innovation that has the potential to transform the global financial system, Jed Anthony Ariens noted. By leveraging blockchain technology, smart contracts, and decentralized protocols, DeFi enables greater financial inclusion, transparency, and innovation while reducing reliance on centralized intermediaries. However, it also faces significant challenges that must be addressed for it to reach its full potential. As the DeFi ecosystem continues to evolve and mature, it is likely to play an increasingly prominent role in shaping the future of finance.

May 16, 2024